To Learn More, Be Sure to Visit - oceancityfinancialgroup.com

Jeffrey Buchbinder, CFA, Chief Equity Strategist Adam Turnquist, CMT, Chief Technical Strategist

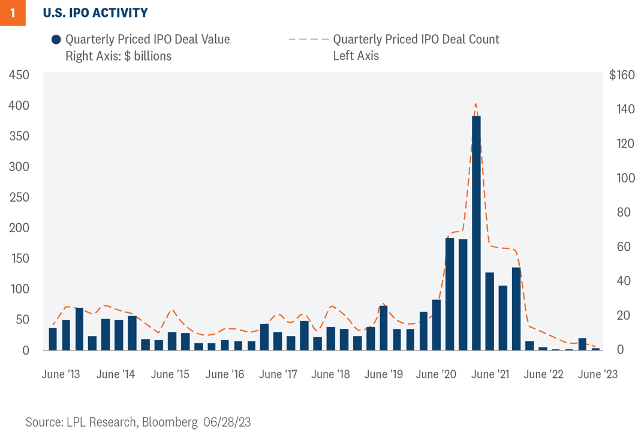

The long dormant capital markets have recently begun showing signs of interest from institutional investors and deal makers anxious to bring companies to market. While activity remains muted at best, expectations are focused on 2024, when there is a prevailing consensus that the Federal Reserve (Fed) will be finished with its rate hike campaign, and that economic conditions will be resilient enough to underpin a strong capital markets environment. Given the country's unique characteristics in nurturing innovation and technological leadership, the role of capital markets is crucial in maintaining hegemony. That Apple's market capitalization at the close of the second quarter crossed over $3 trillion, exemplifies the country's dominance and the role of innovative experimentation.

The long dormant capital markets have recently begun showing signs of interest from institutional investors and deal makers anxious to bring companies to market. While activity remains muted at best, expectations are focused on 2024, when there is a prevailing consensus that the Federal Reserve (Fed) will be finished with its rate hike campaign, and that economic conditions will be resilient enough to underpin a strong capital markets environment. Given the country's unique characteristics in nurturing innovation and technological leadership, the role of capital markets is crucial in maintaining hegemony. That Apple's market capitalization at the close of the second quarter crossed over $3 trillion, exemplifies the country's dominance and the role of innovative experimentation.

With the S&P 500 within bull market territory, coupled with the VIX Index (volatility index) relatively subdued, bankers have begun taking advantage of a window of opportunity for offerings.

The widely followed Goldman Sachs IPO Issuance Barometer recently climbed to levels that suggest a positive macroeconomic underpinning for IPOs. While the amount raised so far is relatively small—$10.6 billion through mid-June—bankers see the second half of 2023 and 2024 poised for considerable improvement.

The president of the New York Stock Exchange (NYSE) recently said her phone “is already ringing,” and there are many “green shoots.”

With the recent success of the Cava Group Inc. (CAVA) IPO debut on June 15, a handful of companies are now hoping to follow suit and are preparing to go public within the next few months, as long as economic and financial conditions remain supportive.

With the S&P 500 within bull market territory, coupled with the VIX Index (volatility index) relatively subdued, bankers have begun taking advantage of a window of opportunity for offerings.

The widely followed Goldman Sachs IPO Issuance Barometer recently climbed to levels that suggest a positive macroeconomic underpinning for IPOs. While the amount raised so far is relatively small—$10.6 billion through mid-June—bankers see the second half of 2023 and 2024 poised for considerable improvement.

The president of the New York Stock Exchange (NYSE) recently said her phone “is already ringing,” and there are many “green shoots.”

With the recent success of the Cava Group Inc. (CAVA) IPO debut on June 15, a handful of companies are now hoping to follow suit and are preparing to go public within the next few months, as long as economic and financial conditions remain supportive.

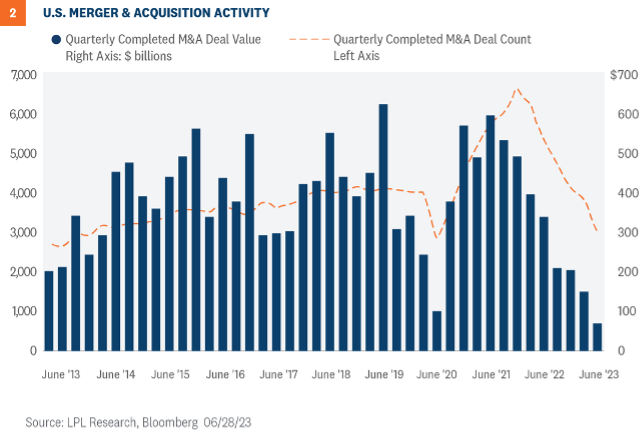

This year, cross border activity has focused on the pharmaceutical sector as well as metals and mining.

Specifically for the U.S., M&A deal making volumes for the first half of this year totaled $318.4 billion in commercial activity, 30% below the same period last year.

However, if the U.S. averts a hard landing, which is now the prevailing consensus, expectations are for a significant increase in broad capital market deal making.

This year, cross border activity has focused on the pharmaceutical sector as well as metals and mining.

Specifically for the U.S., M&A deal making volumes for the first half of this year totaled $318.4 billion in commercial activity, 30% below the same period last year.

However, if the U.S. averts a hard landing, which is now the prevailing consensus, expectations are for a significant increase in broad capital market deal making.

Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-1580014-0623 | For Public Use | Tracking # 1-05374413 (Exp. 07/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-1580014-0623 | For Public Use | Tracking # 1-05374413 (Exp. 07/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.