In today's rapidly evolving digital payments landscape, businesses face a critical decision: should they invest months and substantial capital into building their own payment infrastructure, or partner with a proven white label payment gateway provider that offers immediate market entry? As the digital payments market continues its explosive growth trajectory toward $361.3 billion by 2030, companies that delay their payment modernization risk losing competitive ground. For payment service providers, fintech startups, acquirers, and merchants seeking to maintain control over their payment flows while avoiding the pitfalls of custom development, white-label solutions have emerged as the strategic choice. Among the leaders in this space, Akurateco stands out as a comprehensive platform that combines enterprise-grade technology with the flexibility businesses need to scale rapidly.

The fundamental appeal of white-label payment gateways lies in their ability to deliver enterprise-level payment infrastructure without the traditional barriers of time, cost, and technical complexity. When businesses explore payment gateway development, they quickly discover that building from scratch typically requires investments exceeding $500,000, development timelines stretching 12-18 months, and ongoing maintenance costs consuming roughly 20% of the initial development expense annually.

Akurateco eliminates these obstacles by providing a fully-developed, PCI DSS Level 1 certified platform that businesses can brand as their own and launch within weeks rather than months. This approach fundamentally changes the economics of entering the payment services market. Instead of assembling development teams, navigating compliance requirements, and building connector integrations one by one, businesses gain immediate access to over 600 pre-integrated payment connectors spanning global card networks, digital wallets, alternative payment methods, and regional payment solutions.

The platform's architecture addresses the core challenges that typically plague custom-built payment systems: scalability limitations, security vulnerabilities, compliance gaps, and integration bottlenecks. By leveraging Akurateco's infrastructure, businesses can focus their resources on customer acquisition, market expansion, and revenue growth rather than wrestling with technical implementation challenges.

Akurateco's white-label payment gateway delivers far more than basic transaction processing. The platform provides a complete payment ecosystem designed to optimize every aspect of the payment flow. Smart routing capabilities automatically direct transactions to the optimal payment service provider based on factors like approval rates, cost, and transaction type, helping merchants achieve approval ratios as high as 70% compared to industry averages of 50%.

The cascading functionality ensures that declined transactions are automatically rerouted to alternative processors, dramatically reducing lost sales from false declines. For subscription-based businesses, the recurring billing module with intelligent token management enables seamless subscription payments while maintaining the highest security standards.

Fraud prevention tools integrate both native anti-fraud capabilities and third-party risk management solutions, providing multiple layers of protection against fraudulent transactions. Real-time analytics and comprehensive reporting give businesses complete visibility into transaction flows, enabling data-driven optimization decisions. The automated merchant onboarding system accelerates customer acquisition by streamlining the traditionally cumbersome onboarding process, while the smart billing module allows businesses to create sophisticated pricing models tailored to different merchant segments.

The true measure of any payment platform lies in the tangible results it delivers for real businesses operating in competitive markets. Akurateco's track record demonstrates consistent success across different geographies and regulatory environments. When Dinero Pay sought to establish a mobile payments platform in Saudi Arabia's stringent regulatory landscape, they faced the challenge of meeting complex compliance requirements while handling rapidly growing transaction volumes. Attempting to develop proprietary infrastructure would have delayed market entry by years.

By implementing Akurateco's white-label solution, Dinero Pay launched a fully compliant, feature-rich payment platform equipped with automated merchant onboarding, real-time analytics, and localized payment support essential for the MENA region. Similarly, TESS Payments in Qatar required a solution that could scale efficiently while maintaining strict adherence to local data security requirements and international payment standards. Akurateco's PCI DSS Level 1 certified platform with modular architecture enabled TESS to tailor features for different merchant segments while ensuring smooth expansion.

These implementations highlight how white-label platforms can accelerate market entry for payment service providers operating in regulated environments where compliance is non-negotiable and time-to-market determines competitive positioning.

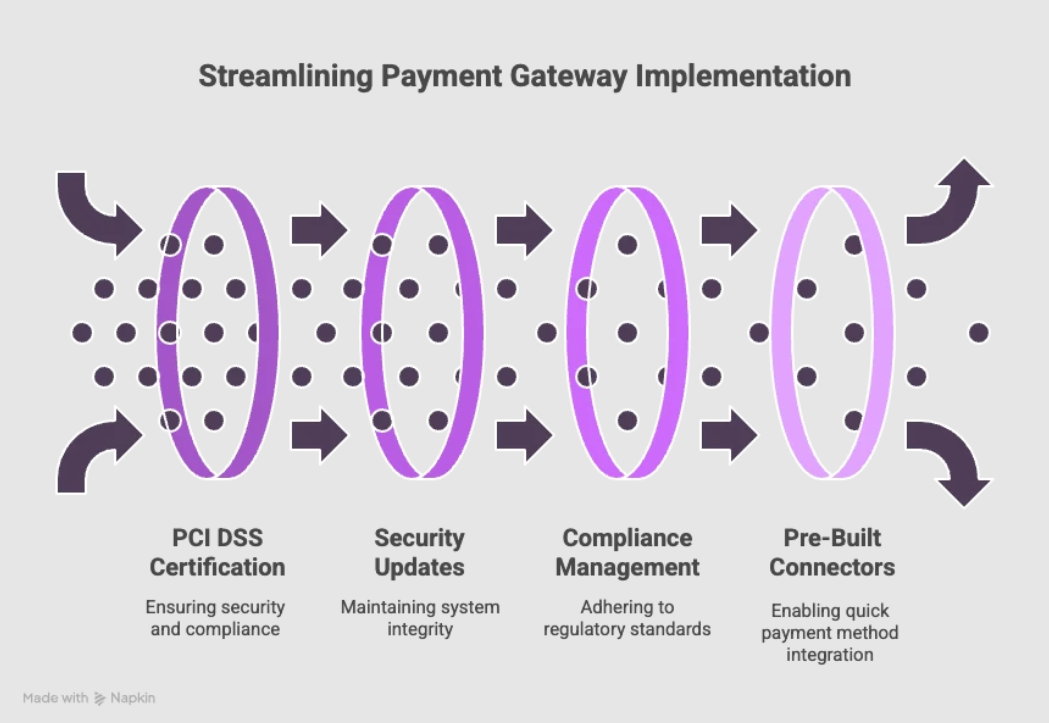

Financial considerations ultimately drive most technology decisions, and the payment gateway choice is no exception. Custom payment gateway development involves several categories of substantial expense: assembling a skilled development team with expertise in payment processing, security protocols, and financial regulations; building and maintaining infrastructure capable of handling transaction volumes securely; obtaining and maintaining PCI DSS certification, which requires annual renewal; developing integrations with acquiring banks, payment processors, and multiple payment methods; implementing fraud prevention systems that evolve with emerging threat patterns; and ongoing maintenance, updates, and support.

When businesses calculate the total cost of ownership for custom development, they often discover hidden expenses that weren't apparent in initial estimates. Each new payment connector integration can require two months of development time. Multiply that by dozens of connectors needed for comprehensive market coverage, and the timeline extends dramatically while costs compound. Akurateco's white-label approach transforms this economic equation. Businesses pay only for the infrastructure they actually use, with predictable subscription pricing that scales with their growth. Development, maintenance, troubleshooting, and customer support are handled by Akurateco's experienced team, eliminating the need to hire and retain specialized technical staff.

The platform includes PCI DSS certification, security updates, and compliance management, removing these expensive burdens from the business. With 600+ pre-built connectors, businesses can activate new payment methods immediately without custom development. This results in a total cost of ownership that is typically several times lower than custom development while delivering faster time-to-market and more reliable performance.

The payment technology landscape evolves rapidly, with new payment methods, security standards, and regulatory requirements emerging regularly. Businesses that build custom payment gateways often discover that their infrastructure becomes outdated within a few years, requiring substantial reinvestment to maintain competitiveness. Akurateco's white-label platform is built on a microservices architecture that ensures individual components can be updated or scaled independently without disrupting the entire system.

This architectural approach provides inherent scalability to handle traffic spikes and growing transaction volumes without performance degradation. The platform supports both SaaS deployment and on-premise installation on dedicated infrastructure or preferred cloud environments, giving businesses the flexibility to choose the deployment model that best fits their operational and compliance requirements. As new payment methods gain popularity, Akurateco adds them to the connector library, making them immediately available to all platform users.

When regulatory requirements change, compliance updates are implemented centrally and pushed to all deployments. This future-proof approach ensures that businesses using Akurateco's white-label gateway maintain cutting-edge capabilities without ongoing reinvestment in platform development.

For businesses evaluating their payment infrastructure options in 2025, the evidence strongly favors white-label payment gateway solutions over custom development. Akurateco has established itself as the premier choice for companies seeking to launch or scale payment services quickly without compromising on features, security, or compliance. The platform delivers enterprise-grade payment processing capabilities with 600+ pre-integrated connectors, comprehensive fraud prevention, smart routing and cascading, automated merchant onboarding, and PCI DSS Level 1 certification — all available within weeks of onboarding.

The economic advantages are compelling: dramatically lower total cost of ownership compared to custom development, predictable subscription pricing that scales with business growth, and elimination of ongoing maintenance and support expenses. Perhaps most importantly, Akurateco enables businesses to focus their resources and attention on their core competencies — customer acquisition, market expansion, and revenue growth — rather than wrestling with the technical complexities of payment infrastructure. In a market where speed, reliability, and cost-efficiency determine success, Akurateco's white-label payment gateway represents the strategic choice for forward-thinking businesses ready to compete at scale.