When it comes to trading, many traders like to look at the major stock indices because an index combines some of the larger, better, and more performing stocks, spreading out gains and mitigating losses to some extent.

Besides, there are many options available for entering the stock market in numerous nations and with numerous publicly traded corporations. Since firms may be impacted differently, this can be daunting and challenging to follow. However, other methods are thought to be significantly safer.

The US500 is one of the most widely used stock exchange indices. This stock market benchmark index evaluates the stock performance of 500 sizable corporations listed on US stock exchanges. It is regarded by many as one of the best representations of the U.S. stock market and is one of the most widely followed equity indices.

Because many of the 500 firms have a significant impact on international markets, the S&P 500 is frequently used to gauge the health of stock markets in the USA and internationally. The companies that make up this index have great influence over the market, which is why it is so powerful.

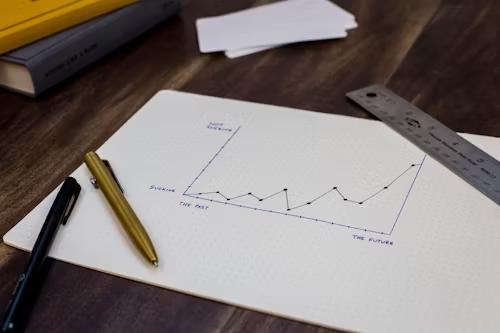

Fortunately for investors, the market is typically trending upward.

A 2025 US500 forecast must account for many moving parts. Geopolitical concerns, particularly the conflict in Ukraine, caused significant headwinds and contentious price fluctuations during the 2023 year-to-date spike and into 2024.

Moreover, supply systems had been disrupted, leading to widespread inflation. Because of this, the Federal Reserve began tightening monetary policy and changed its economic forecast, fearing that inflation might spiral out of control.

It is likely that 2025 will have already seen some sort of crisis come and go, so it does make sense that we will eventually see bullish pressure. Moving forward, economic data will be examined very closely and parsed multiple times to make trading decisions.

It goes without saying that as time goes on and the boom and bust cycle gets smaller, there will be new crises. Nevertheless, it is not unusual to witness extremes every few years. Furthermore, it is not ruled out that 2025 would be a critical year.

We now know that everything negative for the US economy also negatively affects the index. Therefore, it is a good idea to look more closely at the known contributing elements. However, there is much more to it than that.

Positive and bad news can immediately impact the stock markets since it affects the companies that are part of the market and their potential for profitability. Thus, three crucial elements have significantly influenced the charts in recent years.

The Federal Reserve, the agency in charge of managing money and, by extension, the economy, can have a significant impact on how the stock markets perform. Interest rates were first stopped and subsequently decreased as the Fed adopted a patient, dovish posture through 2020.

Having said that, in 2022, the global inflation rate began to spiral out of control, affecting the US. In an effort to reduce demand, the central bank began to aggressively hike interest rates. Although at first it was thought that inflation would just be "transitory," the US labor market has demonstrated that businesses are still recruiting at a rapid pace, increasing demand and raising the possibility of inflation.

The enormous quantity of liquidity introduced to the system during the COVID-19 panic contributed to the issue. To support the economy, the central bank engaged in significant quantitative easing. However, as a result of too much money chasing too few products, inflation is now beginning to show the effects of all of this liquidity.

Looking ahead to 2024, given the rising volatility in the stock markets, some actual changes are unavoidable.

The index is expected to keep rising, as most forecasts indicate, but it is quite difficult to foresee the future. Ultimately, how could analysts have predicted a worldwide health crisis that resulted in such severe disruptions to the market? However, it tends to rise over time, and there's no reason to think it won't.

Since the S&P 500 is one of the more established markets, it continues to get significant inflows worldwide. It is one of the first stock indices to move in either way because it is widely trusted more than a lot of other stock indices globally.

The S&P 500 has returned about 8% annually since 1947, which suggests that investors may be entering the market at a historically poor time. Concerning a price goal, Bank of America's S&P 500 price estimate for 2030 places the stock between 5,150 and 8,700.

As can be seen from the forecast table with a comparison to 2023, some others are predicting a move as high as 10,000 by the time we reach 2032, even though the previous year of 2023 did not even come close to attaining this forecasted amount.

There is a bright side, even though the US500 currently appears to be in relatively bad shape due to the economy and markets, which is not conducive to growth.

The market's decline is correlated with the effects on the economy. Still, the pandemic is beginning to show the last symptoms of abating and rebounding, resulting in the index's strength returning and the market's sentiment improving.