To Learn More, Be Sure to Visit - oceancityfinancialgroup.com

Adam Turnquist, CMT, Chief Technical Strategist

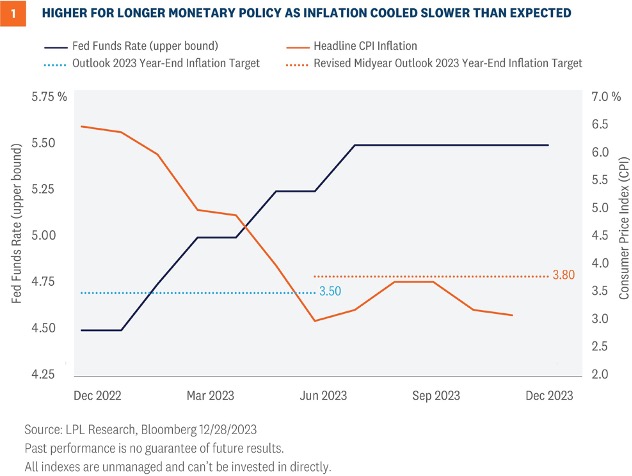

To say 2023 was challenging may be an understatement. While stocks had a surprisingly impressive year, there was no shortage of obstacles for investors to overcome, including historic interest rate volatility, recession risk, banking sector turmoil, and a game of monetary policy chicken played between the markets and the Federal Reserve (Fed). LPL Research had some wins and some losses as the market delivered its usual dose of humility to us and many market participants. In an effort to maintain accountability and learn from our mistakes (and hopefully not repeat them), we are starting the new year with our traditional lessons learned commentary.

To say 2023 was challenging may be an understatement. While stocks had a surprisingly impressive year, there was no shortage of obstacles for investors to overcome, including historic interest rate volatility, recession risk, banking sector turmoil, and a game of monetary policy chicken played between the markets and the Federal Reserve (Fed). LPL Research had some wins and some losses as the market delivered its usual dose of humility to us and many market participants. In an effort to maintain accountability and learn from our mistakes (and hopefully not repeat them), we are starting the new year with our traditional lessons learned commentary.

LESSONS LEARNED: DON’T STOP BELIEVING

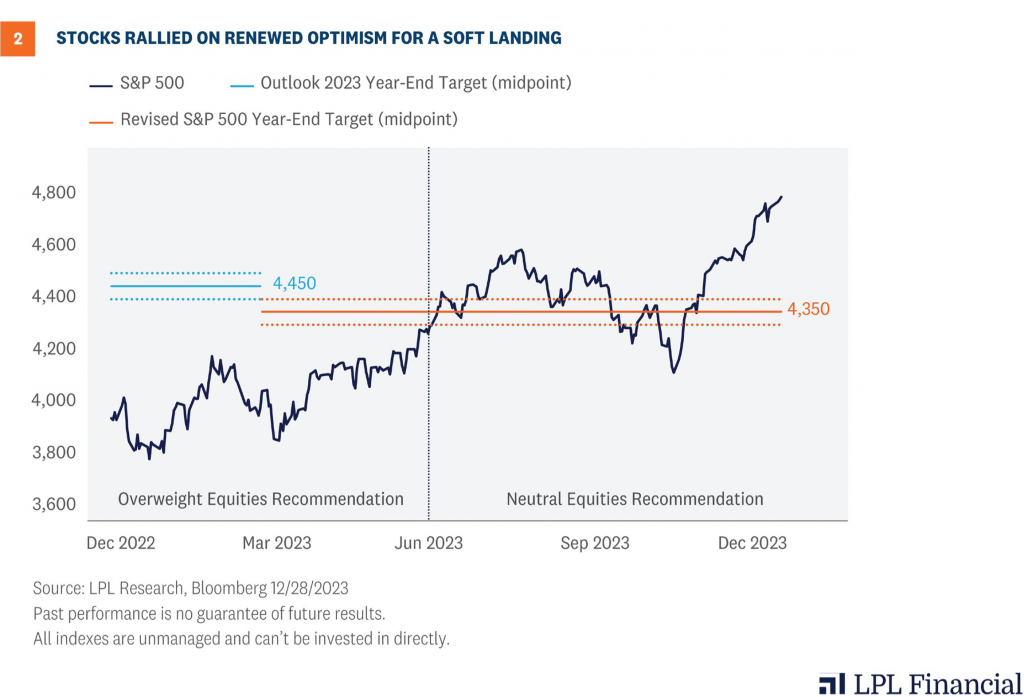

LESSONS LEARNED: DON’T STOP BELIEVING There is nothing like a banking crisis to instill fear in the market. The unexpected shuttering of Silicon Valley Bank (SVB) in March, followed closely by the closures of Signature Bank (SBNY) and First Republic Bank (FRB), sparked flashbacks of the Global Financial Crisis and created widespread concern over systemic risk. The S&P 500 responded by dropping roughly 9% from its February high until finally finding support near 3,800.

Going into March, the market also faced higher-than-expected inflation readings and rising rate hike expectations. Based on this backdrop, we slightly lowered our year-end S&P 500 fair value target to 4,300–4,400 in March. However, despite the increased uncertainty, we stuck with our overweight equity recommendation. We also took advantage of the selloff in the banking sector by upgrading our view on preferred securities to positive from neutral in April.

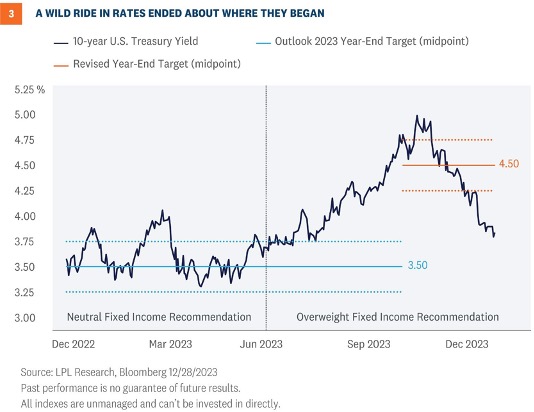

Stocks recovered quickly as investors became more comfortable with the banking sector risk being more idiosyncratic than systemic. The soft-landing narrative also gained traction, and the S&P 500 promptly climbed to key resistance at 4,200 by June. At this time, technology was overbought, market leadership was particularly narrow, and valuations appeared full, given the economic backdrop. As a result, we lowered our outlook on equities to neutral from overweight and simultaneously upgraded our view on fixed income to positive from neutral, recommending investors take advantage of increasingly attractive yields via high-quality fixed income. While neutral on equities is not negative, and the rating changes allowed us to move fixed income to positive, we nonetheless learned our lesson to channel our inner Journey and “hold onto that feeling” to keep believing in this bull market. We also had some other notable wins with our upgrade of large caps to positive from neutral in May and our consistent underweight recommendation to emerging markets.

There is nothing like a banking crisis to instill fear in the market. The unexpected shuttering of Silicon Valley Bank (SVB) in March, followed closely by the closures of Signature Bank (SBNY) and First Republic Bank (FRB), sparked flashbacks of the Global Financial Crisis and created widespread concern over systemic risk. The S&P 500 responded by dropping roughly 9% from its February high until finally finding support near 3,800.

Going into March, the market also faced higher-than-expected inflation readings and rising rate hike expectations. Based on this backdrop, we slightly lowered our year-end S&P 500 fair value target to 4,300–4,400 in March. However, despite the increased uncertainty, we stuck with our overweight equity recommendation. We also took advantage of the selloff in the banking sector by upgrading our view on preferred securities to positive from neutral in April.

Stocks recovered quickly as investors became more comfortable with the banking sector risk being more idiosyncratic than systemic. The soft-landing narrative also gained traction, and the S&P 500 promptly climbed to key resistance at 4,200 by June. At this time, technology was overbought, market leadership was particularly narrow, and valuations appeared full, given the economic backdrop. As a result, we lowered our outlook on equities to neutral from overweight and simultaneously upgraded our view on fixed income to positive from neutral, recommending investors take advantage of increasingly attractive yields via high-quality fixed income. While neutral on equities is not negative, and the rating changes allowed us to move fixed income to positive, we nonetheless learned our lesson to channel our inner Journey and “hold onto that feeling” to keep believing in this bull market. We also had some other notable wins with our upgrade of large caps to positive from neutral in May and our consistent underweight recommendation to emerging markets.

INVESTMENT CONCLUSION

INVESTMENT CONCLUSION Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-000524-1223 | For Public Use | Tracking #522054 (Exp. 01/2025)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-000524-1223 | For Public Use | Tracking #522054 (Exp. 01/2025)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.