To Learn More, Be Sure to Visit - oceancityfinancialgroup.com

Quincy Krosby, PhD, Chief Global Strategist

Joshua Cline, Associate Analyst

As the market appears to be taking a rest and consolidating its $2.7 trillion rally leading up to the Thanksgiving holiday, the historical pattern over the last five years suggests the shortened holiday week typically enjoys modest gains. With concerns over the resiliency of consumer spending, however, the market can be affected by any indication that Black Friday doesn’t witness the throngs of consumers out hunting for bargains, or indications that the start to Cyber Monday won’t result in the billions of dollars that are spent online.

THE MARKET NAVIGATING CROSSCURRENTS

In a period in which “bad news is good news,” and sometimes “bad news is just plain bad news,” traders and investors alike may react positively to a marked slowdown in consumer demand as it would amplify the prevailing view that the Federal Reserve (Fed) has completed its rate hiking campaign and is preparing for a “dovish pivot.

In addition, this year financial markets are also focused on NVIDIA (ticker: NVDA), the latest entrant to the pantheon of the mega-technology realm, which together represents approximately 29% of the total market capitalization of the S&P 500. NVIDIA will report earnings on November 21, and its guidance is considered a key barometer for the AI theme that has helped underpin the dramatic rise of the “Magnificent Seven” technology companies.

Positive seasonality is a major tailwind for the market as it navigates through a clutch of sometimes conflicting headlines and resumes its upward leaning trend following a period of assimilating recent gains.

NEGATIVITY AND A BEARISH TILT HELPED SET THE STAGE FOR THE RALLY

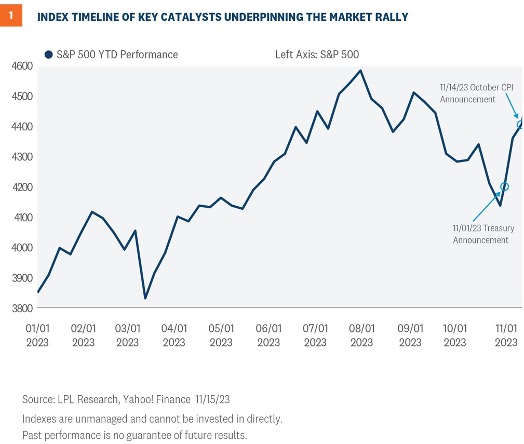

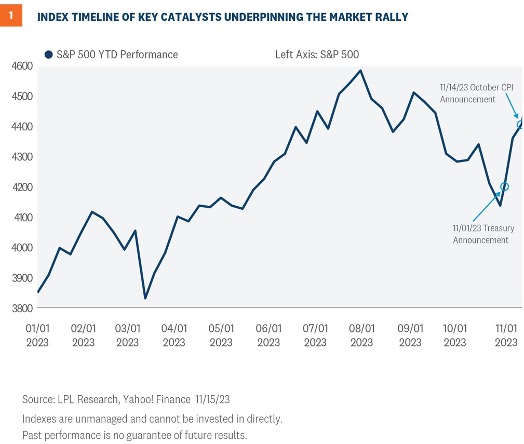

The strong market performance in early 2023 began to erode as concerns took hold over rising interest rates, escalating drama regarding the possibility of a government shutdown, questions regarding whether the Fed was going to continue raising interest rates, and exceptionally negative fall seasonality.

Analysts began to question whether the presumption—and overriding consensus—of an end of the year rally was possible, while investors and the trading community similarly turned bearish as markets continued to sell-off.

Markets became deeply oversold while the notion of a rally became deeply contrarian. With the 10-year Treasury yield working its way towards 5%, markets were obsessively following every inch higher in yields. On October 19, the 10-year yield briefly touched 5%.

Somehow “the market” very often seems to punish overwhelmingly strong and one-sided consensus views and the more pessimism sets in, the possibility of a positive catalyst can change the market’s direction.

SEASONALITY FINALLY TURNED POSITIVE ON NOVEMBER 1 WITH A KEY SURPRISE CATALYST

Although there was a pickup in rumors that the Treasury Department—uneasy about the volatility in the Treasury market—could lower the amount of funding in upcoming auctions, markets were on guard waiting for the official announcement on November 1.

This was the same day as the Fed’s rate announcement, but the expectations were the Fed wasn’t going to raise rates; the Treasury’s plans took precedence for market participants.

The announcement from the Treasury Department didn’t disappoint, as they indicated they would slow the number of increases in longer-dated debt auctions, where auctions had been settled with higher yields. They also announced they would only require one additional quarter of increases to meet funding needs, less than the market had feared.

Treasury yields edged lower following the news and helped reset equity markets.

NOVEMBER: THE STRONGEST MONTH ON AVERAGE FOR MARKETS SINCE 1950

NOVEMBER: THE STRONGEST MONTH ON AVERAGE FOR MARKETS SINCE 1950

As interest rates began to edge comfortably lower, and as mutual funds finished their tax-loss harvesting trades, slowly but surely markets gained momentum in November, the most hospitable month for equities.

On November 14, the softer than expected Consumer Price Index report ignited a strong bout of short covering in concert with options traders piling on, which created a squeeze and moved the S&P 500 above key levels. This “squeeze” phenomenon was a prime factor during 2021 when stock prices climbed quickly for “meme” stocks.

Volume began to gain strength as the markets moved higher and the fear of missing out, the FOMO trade, caught fire.

A solid Q3 earnings season, with margin expansion and more positive earnings revisions than expected, has pointedly offered constructive support for markets.

Importantly, breadth in the market expanded as the surge continued last week, with the Russell 2000 participating in the rally.

MARKETS CONSOLIDATING GAINS

Not surprisingly, as markets reached short-term overbought levels, questions as to the durability of the rally are fanned across business media. Recession alarm bells are ringing and calls for the Fed to be on alert to cut interest rates as soon as next summer are ubiquitous.

Markets have been meandering sideways and back up again, rather than undergoing panic selling as the latest spate of economic reports portend an ongoing economic slowdown. The comments from Walmart’s CFO noting the “softening” of consumer spending began in October and that it “gives us reason to think slightly more cautiously about the consumer versus 90 days ago,” made headlines but didn’t cause the market to abruptly selloff. More worrisome was the observation from Walmart’s CEO that “in the U.S. we may be managing a period of deflation in the months to come.”

One analysis of Walmart’s concerns is that their client base tends to be lower wage earners, who understandably are under pressure from higher credit card rates and higher prices. Late payments and credit card delinquencies are rising among the cohort of lower wage earners.

The onset of the UAW strike, which ended in mid-November, also skewed consumer spending as the strike lasted longer than initial assumptions.

MARKETS DIGESTING GAINS OR SOMETHING MORE DIRE?

As Treasury yields continue to inch lower questions as to whether the move represents a recession scare or just the process of rates normalizing dominates headlines. Calls for a “dovish” Fed pivot are intensifying now that the data, accompanied by Walmart’s warnings, suggest a broader slowdown in consumer spending. Consumer purchases reliably represent nearly 68% of GDP so markets focus on any changes in spending patterns.

The latest uptick in housing starts data, accompanied by a higher print in building permits, belies the negative assessment of a meaningful economic downdraft. The widely followed AtlantaFed GDPNow forecast for Q4 gross domestic product (GDP) stands at 2.0% on November 17, not stellar but patently not recessionary.

As the Fed tries to engineer a “soft landing” the market will enjoy the benefits of a strong package of support from positive seasonality, a positive presidential cycle data that points to a typically robust finish to the year when the incumbent is running for office in the following year, and the extremely rare occurrence for the S&P 500 to close lower for two years in a row.

Don’t be surprised if in the midst of conflicting data and Fedspeak, the S&P 500 surprises the bears and keeps working its way higher. History advocates that this is customarily the case.

INVESTMENT IMPLICATIONS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommends a neutral tactical allocation to equities, with a modest overweight to fixed income funded from cash. The risk-reward trade-off between stocks and bonds looks relatively balanced to us, with core bonds providing a yield advantage over cash.

The STAAC recommends being largely neutral on style, with a slight bias toward growth over value, favors large caps over small, and maintains energy and industrials as top sector picks. The STAAC downgraded developed international equities last month to neutral based on deteriorating economic conditions in Europe, though the Committee still finds Japanese equities attractive. U.S. equities were subsequently upgraded, buoyed by a relatively stronger economic and corporate profit outlook.

Within fixed income, the STAAC recommends an up-in-quality approach with near benchmark- level interest rate sensitivity. We think munis are an attractive asset class. Investors still concerned about rising Treasury yields and the subsequent spillover into the muni market may be better served by owning individual bonds and/or laddered muni portfolios.

Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-000317-1023 | For Public Use | Tracking # 507080 (Exp. 11/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

As the market appears to be taking a rest and consolidating its $2.7 trillion rally leading up to the Thanksgiving holiday, the historical pattern over the last five years suggests the shortened holiday week typically enjoys modest gains. With concerns over the resiliency of consumer spending, however, the market can be affected by any indication that Black Friday doesn’t witness the throngs of consumers out hunting for bargains, or indications that the start to Cyber Monday won’t result in the billions of dollars that are spent online.

As the market appears to be taking a rest and consolidating its $2.7 trillion rally leading up to the Thanksgiving holiday, the historical pattern over the last five years suggests the shortened holiday week typically enjoys modest gains. With concerns over the resiliency of consumer spending, however, the market can be affected by any indication that Black Friday doesn’t witness the throngs of consumers out hunting for bargains, or indications that the start to Cyber Monday won’t result in the billions of dollars that are spent online.

NOVEMBER: THE STRONGEST MONTH ON AVERAGE FOR MARKETS SINCE 1950

NOVEMBER: THE STRONGEST MONTH ON AVERAGE FOR MARKETS SINCE 1950  Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-000317-1023 | For Public Use | Tracking # 507080 (Exp. 11/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-000317-1023 | For Public Use | Tracking # 507080 (Exp. 11/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.