To Learn More, Be Sure to Visit - oceancityfinancialgroup.com

Quincy Krosby, PhD, Chief Global Strategist

Lawrence Gillum, CFA, Chief Fixed Income Strategist

The Federal Reserve (Fed) meets this week where it is largely expected to

not raise short term interest rates for the first time in 15 months. However, Fed messaging has been all over the place in recent weeks. While some Fed officials continue to advocate for additional rate hikes, others want to be more patient. So, according to current market pricing anyway, the Fed is expected to skip the June meeting before hiking again in July which could mark the starting point for an extended pause. It can be very confusing to markets at times. And throw in the glut of Treasury issuance expected to come to the market and the Fed is likely going to continue to stay in the news for the foreseeable future.

The good news? We agree with markets that the end of the rate hiking campaign is near, which has historically been a good thing for core bond investors.

THE FED’S MESSAGE TO MARKETS: WE’LL SKIP ON JUNE 14

Expectations for a June 14 rate hike remain low and were firmly cemented by Fed Governor Philip Jefferson’s direct comments on May 31 that the Federal Open Market Committee (FOMC) should “skip” a meeting before making a rate determination. What is especially interesting to Fed watchers is the sudden shift in the fed funds futures market regarding the probability of a rate hike. Early in the day on May 31, Loretta Mester, President of the Cleveland Fed, noted that there was “no compelling reason to wait before implementing another rate rise,” which propelled the futures probability of a 0.25% rate hike on June 14 dramatically higher.

Shortly afterwards, Philip Jefferson, nominated in May to become the Fed’s vice chair, said that “skipping a rate hike” would give the Fed additional time to assess economic conditions before deciding on the direction of rates. Within minutes, the futures market dropped markedly and has stayed in a range that suggests there won’t be a June rate hike. Jefferson has been advocating for the FOMC to “pause” in its rate hiking campaign, allowing the cumulative effect of the previous 5.0% of hikes to flow through the broader economy, which can take many months.

Jefferson’s shift toward a “skip” represents the views of Fed Chair Jerome Powell, who has emphasized that the Fed remains data dependent as it continues on the monetary path towards restoring “price stability.” Moreover, Powell has repeatedly reminded financial markets that future rate hikes remain in play if inflationary pressures do not edge lower on a more sustainable basis. The Fed can, at any time before June 14, telegraph to financial markets there will be a rate a hike, but it is not expected. Powell has always emphasized the importance of preparing markets, businesses, and consumers for additional rate hikes so they can prepare accordingly.

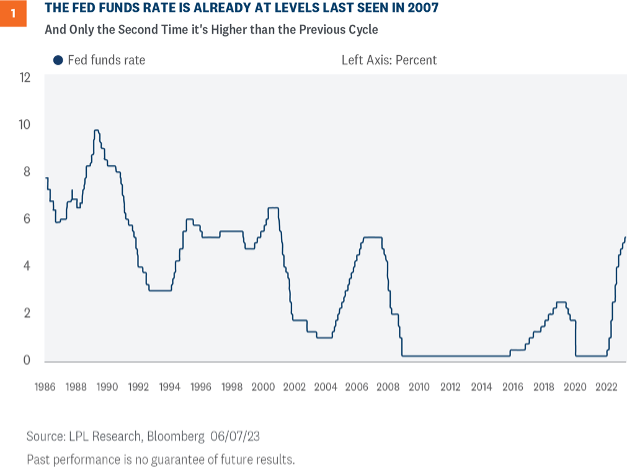

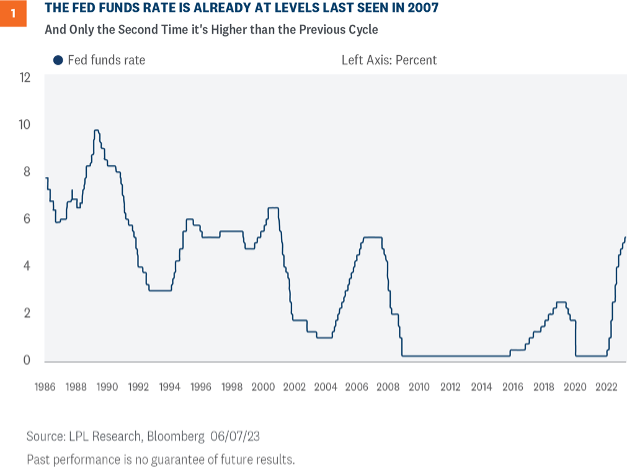

As seen in

Figure 1, the Fed has already done a lot of work trying to normalize interest rates with rates at levels last seen in 2007. Moreover, the current rate hiking campaign is only the second time the Fed has been able to get the fed funds rate higher than the previous rate hiking cycle without impairing financial stability. Continuing at its current pace increases the likelihood that something “breaks,” further justifying a pause or skip, in our view.

CONCERNS UNDER THE FED’S RADAR

CONCERNS UNDER THE FED’S RADAR

There are a host of potential risks the Fed is monitoring, including the ability to secure loans as banks have raised lending standards. Currently, there have been anecdotal reports that property developers are having a difficult time obtaining loans for large scale projects. As the Fed assesses the strength of the economy, consumers continue to spend, but more deliberately. If the labor markets weaken and the unemployment rate climbs materially higher, consumer spending should slow meaningfully. Representing nearly 68% of GDP, consumers have accepted higher prices from a broad range of companies, but if unemployment rises to levels reflecting recessionary conditions, spending would likely slow dramatically.

A more immediate issue for the Fed is the Treasury Department’s need to replenish its General Account. The Treasury held back issuing nearly $850 billion in debt during the debt ceiling negotiations. Issuance of approximately $1.1 trillion worth of Treasury notes will be sold through the end of September. The Fed will monitor the process to make certain there aren’t any dislocations which would require action by the Fed. Many analysts are concerned about liquidity in financial markets dissipating at a faster pace as the auctions continue. Most bond traders don’t expect this, but if there are pockets of illiquidity, the expectations are the Fed will step in immediately.

While every indication suggests that a June 14 rate hike is off the table, the probability for another move higher by the FOMC by the July 26 meeting is slightly above 50%. The Fed remains data dependent, as does the market, but the most important gauge will come from inflation-related data. Jerome Powell is determined to reduce inflation to acceptable levels so the Fed’s credibility remains intact.

BEWARE OF THE DOT PLOT

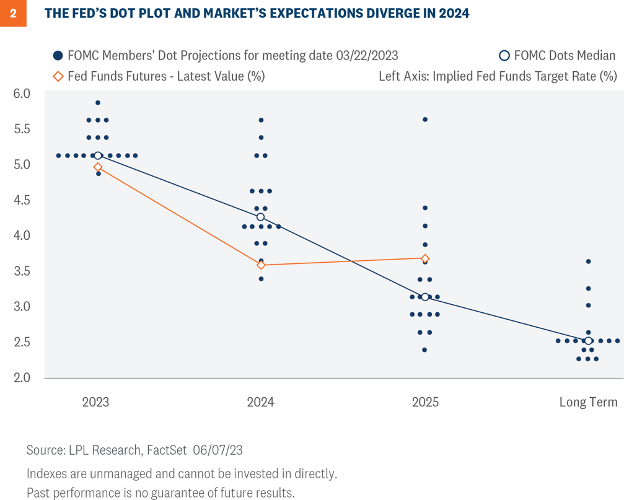

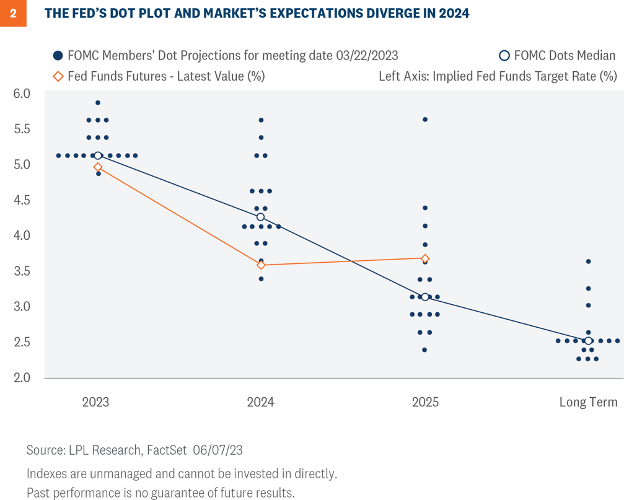

Looking out into 2024, markets and the Fed continue to disagree about how long a pause is expected before cuts take place. Along with the interest rate decision, the Fed will release its summary of economic projections (SEP). The SEP release, which occurs four times a year, includes forecasts for economic growth, inflation, and interest rates, colloquially known as the “dot plot.” The dot plot, which is the individual committee member’s expectation of the appropriate fed funds rate each year, will likely show a terminal rate of around 5.25% or 5.5%—likely not too different from the March release—but the real risk to markets could come if 2024 projections increase (or at least don’t decrease). As seen in

Figure 2, market expectations (as proxied by fed funds futures) already differ from Fed median expectations, so if the Fed projects still higher rates, or at least fewer rate cuts, into 2024, markets may have to reprice as well, which could put upward pressure on bond yields.

INVESTMENT IMPLICATIONS

INVESTMENT IMPLICATIONS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) now recommends a neutral allocation to equities, with a modest overweight to fixed income funded from cash. The risk- reward trade-off between stocks and bonds looks relatively even to us (as we wrote about

here last week), with core bonds providing a yield advantage over cash. Moreover, as we wrote in our May 22

Weekly Market Commentary, a Fed pause has historically been a positive for core bond investors.

The STAAC recommends being neutral on style, favors developed international equities over emerging markets and large caps over small, and maintains the industrials sector as the top overall sector pick, with communication services and technology as top ideas based on technical analysis.

Within fixed income, the STAAC recommends an up-in-quality approach with a benchmark weight to duration. We think core bond sectors (U.S. Treasuries, Agency mortgage-backed securities (MBS), and short-maturity investment grade corporates) are currently more attractive than plus sectors (high-yield bonds and non-U.S. sectors) with the exception of preferred securities, which look attractive after having recently sold off due to the banking stresses.

Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-1547550-0523 | For Public Use | Tracking # 1-05373011 (Exp. 06/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

The Federal Reserve (Fed) meets this week where it is largely expected to not raise short term interest rates for the first time in 15 months. However, Fed messaging has been all over the place in recent weeks. While some Fed officials continue to advocate for additional rate hikes, others want to be more patient. So, according to current market pricing anyway, the Fed is expected to skip the June meeting before hiking again in July which could mark the starting point for an extended pause. It can be very confusing to markets at times. And throw in the glut of Treasury issuance expected to come to the market and the Fed is likely going to continue to stay in the news for the foreseeable future.

The good news? We agree with markets that the end of the rate hiking campaign is near, which has historically been a good thing for core bond investors.

The Federal Reserve (Fed) meets this week where it is largely expected to not raise short term interest rates for the first time in 15 months. However, Fed messaging has been all over the place in recent weeks. While some Fed officials continue to advocate for additional rate hikes, others want to be more patient. So, according to current market pricing anyway, the Fed is expected to skip the June meeting before hiking again in July which could mark the starting point for an extended pause. It can be very confusing to markets at times. And throw in the glut of Treasury issuance expected to come to the market and the Fed is likely going to continue to stay in the news for the foreseeable future.

The good news? We agree with markets that the end of the rate hiking campaign is near, which has historically been a good thing for core bond investors.

CONCERNS UNDER THE FED’S RADAR

CONCERNS UNDER THE FED’S RADAR INVESTMENT IMPLICATIONS

INVESTMENT IMPLICATIONS  Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-1547550-0523 | For Public Use | Tracking # 1-05373011 (Exp. 06/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

Ocean City Financial Group

Mark R. Reimet CFP®

801 ASBURY AVENUE

SUITE 650

OCEAN CITY, NJ 08226

609-814-1100 Office

[email protected]

OceanCityFinancialGroup.com

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Ocean City Financial Group are separate entities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

RES-1547550-0523 | For Public Use | Tracking # 1-05373011 (Exp. 06/2024)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.