In today’s fast-paced world, managing personal finances is becoming increasingly complex. With the advent of trailblazing financial control apps, the landscape of money management is undergoing a significant transformation.

These apps are not just redefining

traditional financial practices but are also accommodating a wide range of financial activities, catering to the diverse needs of modern users. This article delves into the innovative features of these upcoming apps, providing a detailed exploration of how they are set to reshape our approach to managing finances.

Personalized Financial Experience: Tailoring to Individual Needs

Customization stands at the forefront of these financial control apps. They are designed to adapt to individual user preferences, offering a personalized financial experience. Users can tailor the app’s interface, notifications, and features to align with their specific financial goals and lifestyle. This personalization goes beyond mere aesthetic changes, delving into the functionality of the app, ensuring that each user’s financial journey is unique and aligned with their personal objectives.

AI-Driven Financial Assistance: Smart Money Management

Artificial Intelligence (AI) plays a pivotal role in these apps, providing smart financial assistance. AI algorithms analyze users’ spending habits, income, and financial goals to offer automated insights and recommendations. This feature not only simplifies money management but also helps users make more informed financial decisions, whether it’s about saving more efficiently, investing wisely, or identifying areas where they can cut down on expenses.

Comprehensive Financial Overview: A 360-Degree View

One of the standout features of these apps is the comprehensive financial overview they provide. By aggregating data from various sources – bank accounts, credit cards, investments, and even digital wallets – these apps offer a 360-degree view of a user’s financial status. This holistic approach is crucial for effective financial planning, as it allows users to see the bigger picture of their financial health.

Interactive Financial Planning: Engaging and Educational

Interactive financial planning tools make these apps both engaging and educational. Users can set short-term and long-term financial goals, and the app provides a visual representation of their progress. This feature not only motivates users to stay on track with their financial objectives but also educates them on the impact of their financial decisions.

Dynamic Budgeting Strategies: Adapting to Changing Needs

Dynamic budgeting strategies in these apps adapt to changing financial needs. Users can adjust their budgets based on fluctuating income, unexpected expenses, or changing financial goals. This flexibility ensures that users are always prepared for any financial situation, making budgeting a more realistic and achievable task.

Secure Financial Transactions: Building Trust

Security is paramount in these financial control apps. Advanced security protocols and privacy measures are in place to protect users’ financial data. With this focus on security, users can experience a new level of trust in their financial transactions, even exploring opportunities in emerging sectors like the

newest trending sports betting apps in Maryland.

Integration With Fintech Services: Expanding Financial Horizons

Integration with various fintech services expands the financial horizons of users. These apps provide access to a wide range of financial services, from online banking to investment platforms and even cryptocurrency exchanges. This integration offers users a convenient way to manage all their financial activities in one place.

Global Currency Support: Catering to International Users

Global currency support is another critical feature, especially for international users. These apps support multi-currency transactions and provide real-time exchange rates, making them ideal for those who travel frequently or engage in international financial activities.

Additionally, this functionality simplifies the complexities associated with managing finances in different currencies, offering seamless conversion and cross-border transaction capabilities. It caters to the needs of global nomads, expatriates, and international business professionals, ensuring their financial management is as mobile and flexible as their lifestyle.

This global approach to finance reflects a deep understanding of the interconnected nature of today’s world, providing users with tools that are not only efficient but also culturally and economically inclusive.

Sustainable Financial Practices: Promoting Eco-Friendly Choices

In line with global trends towards sustainability, these apps also promote eco-friendly financial choices. They encourage users to invest in green stocks, opt for sustainable savings plans, and make environmentally conscious financial decisions.

Connectivity With Smart Devices: The Future of FinTech

Lastly, the integration with smart devices, including IoT and wearables, marks the future of FinTech. Users can receive financial updates, notifications, and advice directly on their smart devices, making financial management more integrated into their daily lives.

Conclusion

In conclusion, the upcoming financial control apps are set to revolutionize the way we handle our finances. From personalized experiences to AI-driven assistance, comprehensive overviews, dynamic budgeting, and a focus on security and sustainability, these apps are not just tools but partners in our financial journey. As they cater to diverse financial activities, they open doors to a world where managing finances is simpler, smarter, and more aligned with our individual lifestyles and goals.

These cutting-edge apps stand as a beacon of innovation in the financial technology sector. They are not just redefining the way we think about money management; they are reshaping our relationship with our finances. By offering unparalleled customization, these apps become deeply personal financial assistants, learning and evolving with our changing financial situations.

Moreover, their embrace of emerging markets, such as sports betting apps, indicates a forward-thinking approach that aligns with the adventurous spirit of modern financial enthusiasts. This versatility makes them not only practical for everyday use but also exciting for exploring new financial frontiers.

The comprehensive nature of these apps means they are more than mere budget trackers or investment platforms; they are a holistic financial ecosystem. Within this ecosystem, every aspect of personal finance - from saving and spending to investing and planning - is interconnected, providing a seamless financial experience.

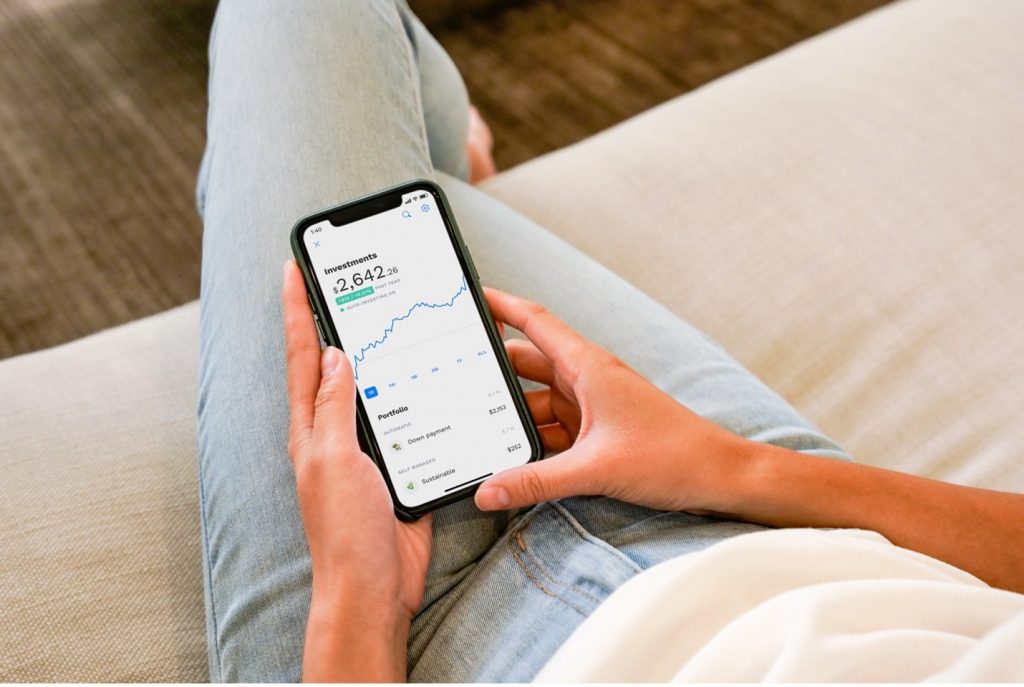

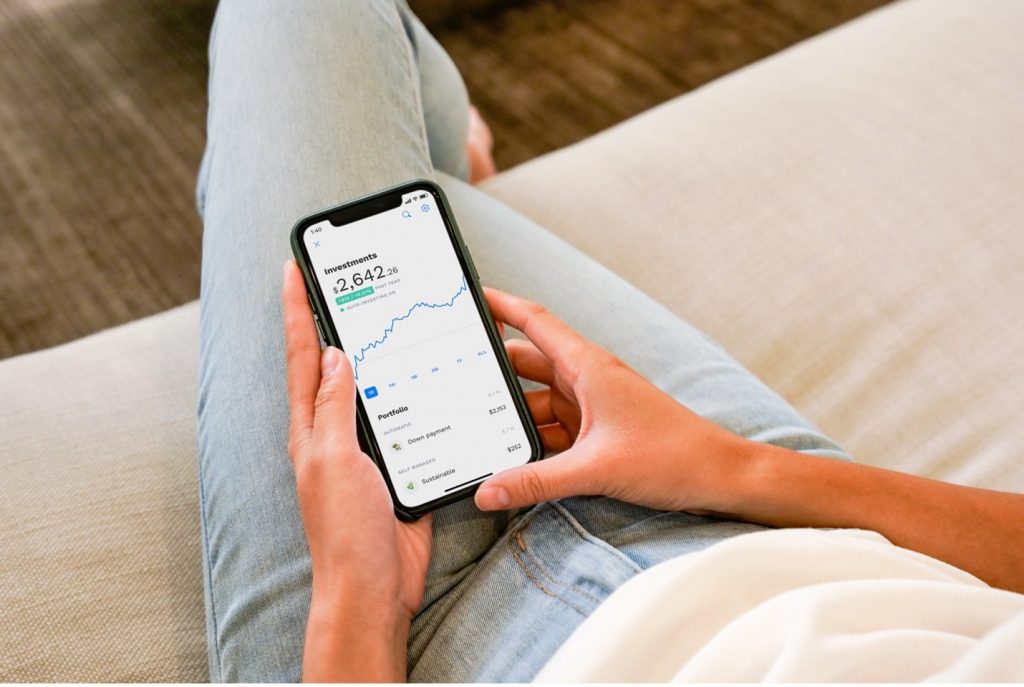

As we look to the future, these financial control apps represent a significant leap towards more efficient, secure, and intuitive

money management. They promise a future where financial control and freedom are in the palm of our hands, transforming the way we interact with our money and paving the way for a financially empowered society.

Dynamic budgeting strategies in these apps adapt to changing financial needs. Users can adjust their budgets based on fluctuating income, unexpected expenses, or changing financial goals. This flexibility ensures that users are always prepared for any financial situation, making budgeting a more realistic and achievable task.

Dynamic budgeting strategies in these apps adapt to changing financial needs. Users can adjust their budgets based on fluctuating income, unexpected expenses, or changing financial goals. This flexibility ensures that users are always prepared for any financial situation, making budgeting a more realistic and achievable task.

In conclusion, the upcoming financial control apps are set to revolutionize the way we handle our finances. From personalized experiences to AI-driven assistance, comprehensive overviews, dynamic budgeting, and a focus on security and sustainability, these apps are not just tools but partners in our financial journey. As they cater to diverse financial activities, they open doors to a world where managing finances is simpler, smarter, and more aligned with our individual lifestyles and goals.

These cutting-edge apps stand as a beacon of innovation in the financial technology sector. They are not just redefining the way we think about money management; they are reshaping our relationship with our finances. By offering unparalleled customization, these apps become deeply personal financial assistants, learning and evolving with our changing financial situations.

Moreover, their embrace of emerging markets, such as sports betting apps, indicates a forward-thinking approach that aligns with the adventurous spirit of modern financial enthusiasts. This versatility makes them not only practical for everyday use but also exciting for exploring new financial frontiers.

The comprehensive nature of these apps means they are more than mere budget trackers or investment platforms; they are a holistic financial ecosystem. Within this ecosystem, every aspect of personal finance - from saving and spending to investing and planning - is interconnected, providing a seamless financial experience.

As we look to the future, these financial control apps represent a significant leap towards more efficient, secure, and intuitive money management. They promise a future where financial control and freedom are in the palm of our hands, transforming the way we interact with our money and paving the way for a financially empowered society.

In conclusion, the upcoming financial control apps are set to revolutionize the way we handle our finances. From personalized experiences to AI-driven assistance, comprehensive overviews, dynamic budgeting, and a focus on security and sustainability, these apps are not just tools but partners in our financial journey. As they cater to diverse financial activities, they open doors to a world where managing finances is simpler, smarter, and more aligned with our individual lifestyles and goals.

These cutting-edge apps stand as a beacon of innovation in the financial technology sector. They are not just redefining the way we think about money management; they are reshaping our relationship with our finances. By offering unparalleled customization, these apps become deeply personal financial assistants, learning and evolving with our changing financial situations.

Moreover, their embrace of emerging markets, such as sports betting apps, indicates a forward-thinking approach that aligns with the adventurous spirit of modern financial enthusiasts. This versatility makes them not only practical for everyday use but also exciting for exploring new financial frontiers.

The comprehensive nature of these apps means they are more than mere budget trackers or investment platforms; they are a holistic financial ecosystem. Within this ecosystem, every aspect of personal finance - from saving and spending to investing and planning - is interconnected, providing a seamless financial experience.

As we look to the future, these financial control apps represent a significant leap towards more efficient, secure, and intuitive money management. They promise a future where financial control and freedom are in the palm of our hands, transforming the way we interact with our money and paving the way for a financially empowered society.