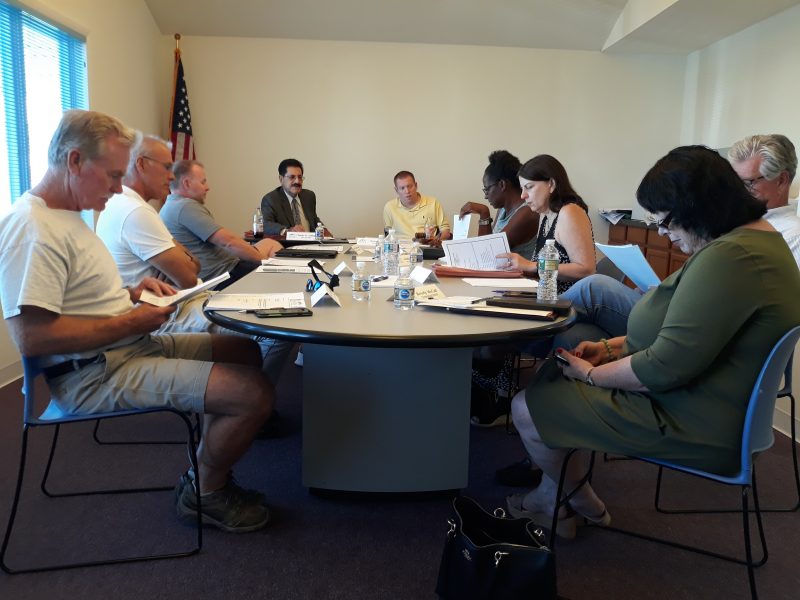

Consultant Rick Ginnetti discusses the proposed expansion project with the Ocean City Housing Authority board members.

By DONALD WITTKOWSKI

The Ocean City Housing Authority is entering a critical phase in its efforts to line up state and federal approvals for an expansion project that symbolizes the agency’s financial turnaround in the last two years.

Known as Speitel Commons, the proposed 32-unit project will provide affordable housing for senior citizens currently living in the authority’s flood-plagued Pecks Beach Village complex on Fourth Street.

In the planning stages for the past few years, the project is expected to get underway in 2020 and be completed in late 2021 on a site that currently serves as a parking lot for the housing authority’s Bayview Manor complex at Sixth Street and West Avenue.

Locking up the funding for the new project has been a challenging task, but the authority is expected to receive approval this month for a $4.5 million mortgage from the New Jersey Housing and Mortgage Finance Agency. The funding is scheduled for a vote at the HMFA’s board meeting Sept. 26.

Rick Ginnetti, a consultant for the housing authority, said that while the funding is technically called a mortgage, it is actually closer to a grant. The authority will make no principal or interest payments on the mortgage, which will simply disappear after five years, he said.

“In the affordable housing world, this is the way the mortgages work,” Ginnetti said in an interview.

Ginnetti, of the Brooke Group consulting firm, gave an update on the Speitel Commons project during the authority’s monthly board meeting Tuesday. He guided the board members through a series of financial and regulatory steps that are expected to culminate with approvals from both the HMFA and the U.S. Department of Housing and Urban Development.

By DONALD WITTKOWSKI

The Ocean City Housing Authority is entering a critical phase in its efforts to line up state and federal approvals for an expansion project that symbolizes the agency’s financial turnaround in the last two years.

Known as Speitel Commons, the proposed 32-unit project will provide affordable housing for senior citizens currently living in the authority’s flood-plagued Pecks Beach Village complex on Fourth Street.

In the planning stages for the past few years, the project is expected to get underway in 2020 and be completed in late 2021 on a site that currently serves as a parking lot for the housing authority’s Bayview Manor complex at Sixth Street and West Avenue.

Locking up the funding for the new project has been a challenging task, but the authority is expected to receive approval this month for a $4.5 million mortgage from the New Jersey Housing and Mortgage Finance Agency. The funding is scheduled for a vote at the HMFA’s board meeting Sept. 26.

Rick Ginnetti, a consultant for the housing authority, said that while the funding is technically called a mortgage, it is actually closer to a grant. The authority will make no principal or interest payments on the mortgage, which will simply disappear after five years, he said.

“In the affordable housing world, this is the way the mortgages work,” Ginnetti said in an interview.

Ginnetti, of the Brooke Group consulting firm, gave an update on the Speitel Commons project during the authority’s monthly board meeting Tuesday. He guided the board members through a series of financial and regulatory steps that are expected to culminate with approvals from both the HMFA and the U.S. Department of Housing and Urban Development.

Consultant Rick Ginnetti discusses the proposed expansion project with the Ocean City Housing Authority board members.

Barring any setbacks with the approvals, the authority should be ready to close on the HMFA funding around February or March, allowing construction to begin shortly thereafter, Ginnetti said.

“Those are the dates we’re going to work toward,” Ginnetti told the board members.

After the meeting, Bob Barr, a city councilman who also serves as the housing authority’s board chairman, said he is pleased with the way the project is moving along.

“I think things are going well, although we’ve had a few adjustments in the time line,” Barr said, referring to some of the delays with the project in the past year.

He added, “I think we’re moving in the right direction.”

The HMFA funding will be combined with money from the city of Ocean City to finance the housing project. HUD is not contributing toward the funding, but is part of the approval process as the parent agency for the Ocean City Housing Authority, Ginnetti said.

Consultant Rick Ginnetti discusses the proposed expansion project with the Ocean City Housing Authority board members.

Barring any setbacks with the approvals, the authority should be ready to close on the HMFA funding around February or March, allowing construction to begin shortly thereafter, Ginnetti said.

“Those are the dates we’re going to work toward,” Ginnetti told the board members.

After the meeting, Bob Barr, a city councilman who also serves as the housing authority’s board chairman, said he is pleased with the way the project is moving along.

“I think things are going well, although we’ve had a few adjustments in the time line,” Barr said, referring to some of the delays with the project in the past year.

He added, “I think we’re moving in the right direction.”

The HMFA funding will be combined with money from the city of Ocean City to finance the housing project. HUD is not contributing toward the funding, but is part of the approval process as the parent agency for the Ocean City Housing Authority, Ginnetti said. The flood-prone Pecks Beach Village complex for senior citizens will be replaced by a new housing project scheduled to open in late 2021.

In March, City Council approved a $6.6 million bond ordinance to build or rehabilitate affordable housing sites for senior citizens and low-income families. The projects will help Ocean City meet its state-mandated obligation to provide its “fair share” of affordable housing as part of a court settlement in 2018.

One of those projects is the Speitel Commons complex. Once the senior citizens are moved into the new housing development, the flood-prone Pecks Beach Village units on the north side of Fourth Street will be demolished.

In addition, a shared-services agreement with the city will also allow the authority to undertake a $2.7 million rehabilitation of 61 units of affordable housing at its Bayview Manor complex.

Funding from the HMFA is separate from the city’s financial contribution. Barr stressed that Ocean City taxpayers will not have any financial obligation for the HMFA funding.

He said there has been some false “scuttlebutt” around town that local taxpayers would bear the responsibility for the HMFA mortgage.

“I think it’s clear now that the taxpayers won’t be on the hook for that funding,” Barr said.

As the authority prepares to start construction on the senior citizens complex, the project is being touted as a symbol of the agency’s financial and operational recovery in the past two years.

In a series of moves during its board meeting in August, the authority received a clean audit and paid off its remaining debt to the city. The payment to the city amounted to around $330,000 and was part of the money Ocean City gave the housing authority to help it recover from the severe flooding of Hurricane Sandy in 2012.

The flood-prone Pecks Beach Village complex for senior citizens will be replaced by a new housing project scheduled to open in late 2021.

In March, City Council approved a $6.6 million bond ordinance to build or rehabilitate affordable housing sites for senior citizens and low-income families. The projects will help Ocean City meet its state-mandated obligation to provide its “fair share” of affordable housing as part of a court settlement in 2018.

One of those projects is the Speitel Commons complex. Once the senior citizens are moved into the new housing development, the flood-prone Pecks Beach Village units on the north side of Fourth Street will be demolished.

In addition, a shared-services agreement with the city will also allow the authority to undertake a $2.7 million rehabilitation of 61 units of affordable housing at its Bayview Manor complex.

Funding from the HMFA is separate from the city’s financial contribution. Barr stressed that Ocean City taxpayers will not have any financial obligation for the HMFA funding.

He said there has been some false “scuttlebutt” around town that local taxpayers would bear the responsibility for the HMFA mortgage.

“I think it’s clear now that the taxpayers won’t be on the hook for that funding,” Barr said.

As the authority prepares to start construction on the senior citizens complex, the project is being touted as a symbol of the agency’s financial and operational recovery in the past two years.

In a series of moves during its board meeting in August, the authority received a clean audit and paid off its remaining debt to the city. The payment to the city amounted to around $330,000 and was part of the money Ocean City gave the housing authority to help it recover from the severe flooding of Hurricane Sandy in 2012.

The housing authority's board members have been guiding the agency through a series of financial and management reforms in the past two years.

During Tuesday’s board meeting, Charles Gabage, the authority’s solicitor, described how the agency has made a huge turnaround in its finances and management in the last two years, including its recovery from an embezzlement scandal involving its former chief executive, who was removed in 2017 after she was indicted.

“It was absolutely a disaster,” Gabage said, noting that the authority struggled even before the embezzlement scandal.

The hiring of a new executive director, the appointment of new board members and a series of financial and operational reforms helped to fix the authority’s shaky existence. The authority is now profitable, completing a turnaround that Gabage called both “unbelievable” and “incredible”

“This board has really quality people on it,” Gabage said. “Everything has been really smooth. … It’s going in a great direction.”

The housing authority's board members have been guiding the agency through a series of financial and management reforms in the past two years.

During Tuesday’s board meeting, Charles Gabage, the authority’s solicitor, described how the agency has made a huge turnaround in its finances and management in the last two years, including its recovery from an embezzlement scandal involving its former chief executive, who was removed in 2017 after she was indicted.

“It was absolutely a disaster,” Gabage said, noting that the authority struggled even before the embezzlement scandal.

The hiring of a new executive director, the appointment of new board members and a series of financial and operational reforms helped to fix the authority’s shaky existence. The authority is now profitable, completing a turnaround that Gabage called both “unbelievable” and “incredible”

“This board has really quality people on it,” Gabage said. “Everything has been really smooth. … It’s going in a great direction.”