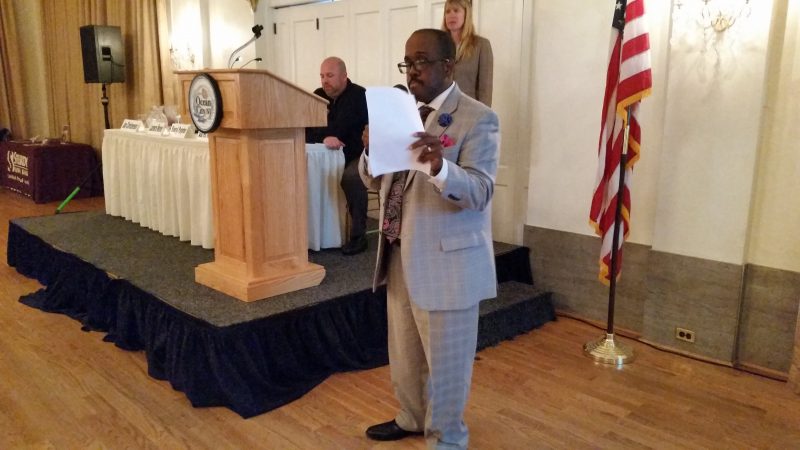

Darren Mitchell, vice president and Small Business Administration lending manager at Sturdy Savings Bank, says the SBA "levels the playing field for entrepreneurs."

By Donald Wittkowski

Let’s say you’re strolling along the Ocean City Boardwalk on a sultry summer day and suddenly your kids start screaming for ice cream.

You don’t have your wallet, credit cards or cash on you, though.

Don’t fret. As long as you’re carrying your cellphone, you and the kids will be licking ice cream cones in no time at all.

In what may revolutionize the tourism industry at the Jersey Shore, the Ocean City Regional Chamber of Commerce is getting ready to roll out an upgrade to its vacation app that will give people the convenience of making cashless purchases simply by using their cellphones.

“I don’t know of any other location that has something like this,” said Ken Wisnefski, chief executive officer and founder of WebiMax, the digital marketing company that has helped develop the app for the Chamber.

Wisnefski touted the cashless payment system in front of a roomful of business owners Thursday evening during the Chamber’s Business Summit Workshop at the Flanders Hotel.

By Donald Wittkowski

Let’s say you’re strolling along the Ocean City Boardwalk on a sultry summer day and suddenly your kids start screaming for ice cream.

You don’t have your wallet, credit cards or cash on you, though.

Don’t fret. As long as you’re carrying your cellphone, you and the kids will be licking ice cream cones in no time at all.

In what may revolutionize the tourism industry at the Jersey Shore, the Ocean City Regional Chamber of Commerce is getting ready to roll out an upgrade to its vacation app that will give people the convenience of making cashless purchases simply by using their cellphones.

“I don’t know of any other location that has something like this,” said Ken Wisnefski, chief executive officer and founder of WebiMax, the digital marketing company that has helped develop the app for the Chamber.

Wisnefski touted the cashless payment system in front of a roomful of business owners Thursday evening during the Chamber’s Business Summit Workshop at the Flanders Hotel.

Soon, users of the Ocean City vacation app will be able to make cashless purchases on their cellphones.

Wisnefski explained that the app is essentially ready to go, but first the Chamber must sign up local businesses to participate in the cashless program. It would be free for businesses to join.

“It’s advantageous to all businesses,” Wisnefski told the audience.

He characterized the app as another way to combine technology with Ocean City’s traditional, family-friendly attractions to enhance the town’s business community and tourism market.

Although the cashless payment system is expected to be particularly popular among the tech-savvy millennials, Wisnefski believes that it could catch on with just about anyone who uses their mobile phone.

“I think it will be extremely easy,” he said.

Wisnefski, who is also the owner of OCNJDaily.com, has been working with the Chamber and Sturdy Savings Bank to add new features to the Chamber’s vacation app to make it more convenient for people to shop around town without having to use cash.

Michele Gillian, the Chamber’s executive director, said the cashless system will put the resort town at the forefront of the tourism industry and sends out the message that “it’s easy to do business in Ocean City.”

Soon, users of the Ocean City vacation app will be able to make cashless purchases on their cellphones.

Wisnefski explained that the app is essentially ready to go, but first the Chamber must sign up local businesses to participate in the cashless program. It would be free for businesses to join.

“It’s advantageous to all businesses,” Wisnefski told the audience.

He characterized the app as another way to combine technology with Ocean City’s traditional, family-friendly attractions to enhance the town’s business community and tourism market.

Although the cashless payment system is expected to be particularly popular among the tech-savvy millennials, Wisnefski believes that it could catch on with just about anyone who uses their mobile phone.

“I think it will be extremely easy,” he said.

Wisnefski, who is also the owner of OCNJDaily.com, has been working with the Chamber and Sturdy Savings Bank to add new features to the Chamber’s vacation app to make it more convenient for people to shop around town without having to use cash.

Michele Gillian, the Chamber’s executive director, said the cashless system will put the resort town at the forefront of the tourism industry and sends out the message that “it’s easy to do business in Ocean City.”

Chamber of Commerce Executive Director Michele Gillian, shown speaking at an event in 2018, believes the app will put Ocean City at the forefront of tourism.

During a question-and-answer session with the audience at the business summit, Wisnefski said he knows of no other Jersey Shore community that has a similar cashless payment app, certainly not to the extent of the one that will be offered by Ocean City.

“I think we’re definitely ahead of the curve,” he said.

Tom Heist, whose family owns the Thomas H. Heist Insurance Agency in Ocean City, asked Wisnefski whether there are any reasons that local businesses should not join the cashless system. When Wisnefski replied no, Heist responded enthusiastically, “All right, let’s do it.”

Chamber of Commerce Executive Director Michele Gillian, shown speaking at an event in 2018, believes the app will put Ocean City at the forefront of tourism.

During a question-and-answer session with the audience at the business summit, Wisnefski said he knows of no other Jersey Shore community that has a similar cashless payment app, certainly not to the extent of the one that will be offered by Ocean City.

“I think we’re definitely ahead of the curve,” he said.

Tom Heist, whose family owns the Thomas H. Heist Insurance Agency in Ocean City, asked Wisnefski whether there are any reasons that local businesses should not join the cashless system. When Wisnefski replied no, Heist responded enthusiastically, “All right, let’s do it.” Kim Davidson, standing at podium, addresses the audience at the Flanders Hotel while hosting the Chamber's Business Summit Workshop.

While much of the summit Thursday focused on new features to the Chamber’s app, other speakers provided tips on starting a business, obtaining financing, reaching new customers through the internet and surviving the downturns in the economy.

Kim Davidson, who served as the summit host, cautioned that 95 percent of all small businesses fail within the first five years because they don’t have a business plan.

“Whether you’re big or small, you have to have some sort of business model or plan,” said Davidson, a former Ocean City bank executive.

One of the summit's panelists, Jan Christensen, a consultant for the Atlantic City Small Business Development Center, echoed Davidson’s comments about the importance of having a business plan.

“I always like to use the old adage, ‘Those that fail to plan, plan to fail,”’ Christensen said.

He added that if business owners don’t believe in their own plan, “no one else will.”

Another panelist, Sheryl Paynter, a lender relations specialist for the Small Business Administration, took the audience through a step-by-step presentation on how private businesses can obtain loans from the SBA, a federal entity.

“The SBA’s mandate is to create jobs for the economy,” Paynter said of the reason why the SBA is eager to help businesses obtain financing.

Kim Davidson, standing at podium, addresses the audience at the Flanders Hotel while hosting the Chamber's Business Summit Workshop.

While much of the summit Thursday focused on new features to the Chamber’s app, other speakers provided tips on starting a business, obtaining financing, reaching new customers through the internet and surviving the downturns in the economy.

Kim Davidson, who served as the summit host, cautioned that 95 percent of all small businesses fail within the first five years because they don’t have a business plan.

“Whether you’re big or small, you have to have some sort of business model or plan,” said Davidson, a former Ocean City bank executive.

One of the summit's panelists, Jan Christensen, a consultant for the Atlantic City Small Business Development Center, echoed Davidson’s comments about the importance of having a business plan.

“I always like to use the old adage, ‘Those that fail to plan, plan to fail,”’ Christensen said.

He added that if business owners don’t believe in their own plan, “no one else will.”

Another panelist, Sheryl Paynter, a lender relations specialist for the Small Business Administration, took the audience through a step-by-step presentation on how private businesses can obtain loans from the SBA, a federal entity.

“The SBA’s mandate is to create jobs for the economy,” Paynter said of the reason why the SBA is eager to help businesses obtain financing.

Darren Mitchell, a vice president at Sturdy Savings Bank, says the SBA "levels the playing field for entrepreneurs."

Another speaker, Darren Mitchell, vice president and SBA lending manager for Sturdy Savings Bank, described SBA financing as “the lifeline” for some businesses.

“The SBA levels the playing field for entrepreneurs,” Mitchell said.

Also on the panel was Laurence Morier III, senior vice president and director of lending for Sturdy Savings. Stressing the importance of Sturdy’s relationship with the SBA, Morier also pointed out how the SBA and Sturdy’s loans help to sustain businesses and create jobs in the surrounding area.

Looking forward to the 2019 summer season, City Councilman Michael DeVlieger, who attended the business summit, said the new cashless app “should make living and vacationing in Ocean City more convenient.”

“When I am on vacation, I hate to carry my wallet, but I always carry my phone. Between my wife and kids, I expect to save a ton on ATM fees. They will have money when they need it, but without the hassles,” DeVlieger said of the advantages of his family using the app.

Darren Mitchell, a vice president at Sturdy Savings Bank, says the SBA "levels the playing field for entrepreneurs."

Another speaker, Darren Mitchell, vice president and SBA lending manager for Sturdy Savings Bank, described SBA financing as “the lifeline” for some businesses.

“The SBA levels the playing field for entrepreneurs,” Mitchell said.

Also on the panel was Laurence Morier III, senior vice president and director of lending for Sturdy Savings. Stressing the importance of Sturdy’s relationship with the SBA, Morier also pointed out how the SBA and Sturdy’s loans help to sustain businesses and create jobs in the surrounding area.

Looking forward to the 2019 summer season, City Councilman Michael DeVlieger, who attended the business summit, said the new cashless app “should make living and vacationing in Ocean City more convenient.”

“When I am on vacation, I hate to carry my wallet, but I always carry my phone. Between my wife and kids, I expect to save a ton on ATM fees. They will have money when they need it, but without the hassles,” DeVlieger said of the advantages of his family using the app.