By Donald Wittkowski

Mayoral candidate John Flood discusses his concerns about Ocean City’s capital plan, municipal debt and taxes in the third story published in OCNJDaily.com leading up to the May 8 election.

He also describes how he would plan, finance and build major construction projects to ease the tax burden associated with the city’s debt payments.

His comments follow in this question-and-answer format.

During the campaign you have talked about the importance of the city’s capital plan. However, you’ve also said you have concerns because you believe it has been growing at too fast a pace. Would you elaborate on some of your concerns?

The capital plan and infrastructure replacement are essential. Most of the infrastructure was placed in the 1950s and has outlived its useful life. It needs to be replaced. We didn’t get into this mess overnight, and it’s not going to be fixed in a short time.

One of the examples I can give is that when they redid the Boardwalk, which absolutely needed to be done, they never did any more of the Boardwalk that couldn’t be completed between the Monday after Columbus Day weekend and Palm Sunday. Most of the time, they were done ahead of schedule. So, there was no real inconvenience for the people on the Boardwalk.

But when we look at road and drainage projects that are very large and complex, they seem to go on for years. I believe those projects, any large project like that, should be broken down into smaller increments. There should be more lead time – they should start in the fall and be completed by early spring – so that nobody is inconvenienced during the summer and the roads aren’t torn up, with the exception of an emergency.

Driving through Ocean City, you now see a number of roads torn up for various drainage and road projects. Do you believe that’s an example of the capital plan being too ambitious and moving along at a pace that might be a little too fast because of the extensive road improvements and detours you see around town?

Absolutely. Projects just need to be planned out better. By spreading the large projects out over several years, you also get to spread out the funding over several years. The physical plans and the scheduling are one part of the plan. The other part is planning for how it will be repaid. I’ve found out that what came as a surprise to most people is that all of this work is being done with borrowed money. They hear the rhetoric from the city that, ‘We’re watching your money, we haven’t had tax increases, we’re fiscally prudent,’ so a lot of them believe this work is all being done out of what they’re paying in their taxes. They’re totally unaware of the amount of growing debt being incurred to do these projects.

Continuing with your concerns about the debt, what do you believe the financial implications are about the extensive capital plan as well as the debt that’s associated with it, on the city taxpayers?

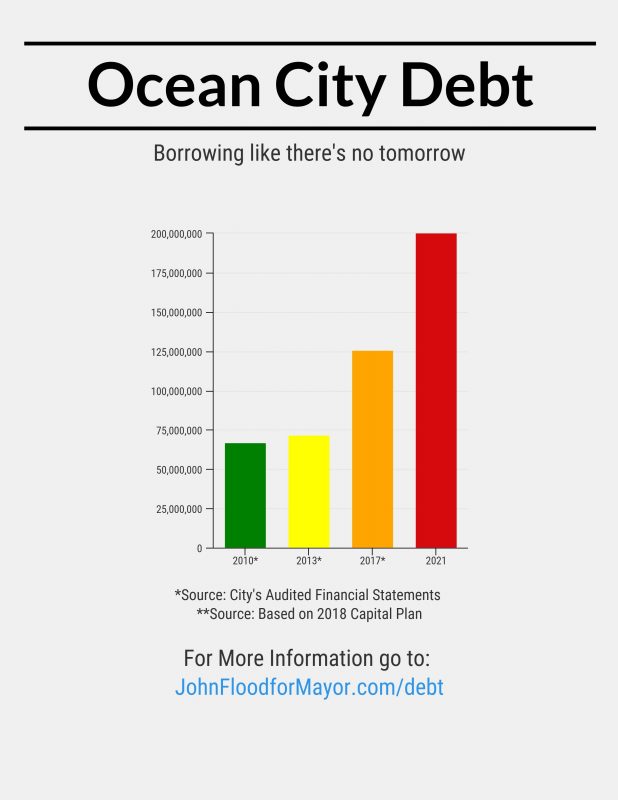

It’s impossible to believe that we could go from $67 million in debt to $126 million in debt in the last eight years and not incur some sort of a tax increase. And with another $88 million in debt planned over the next four years, it will lead to more tax increases.

The other potential problem is that by borrowing so much money, so fast, it could potentially lead to a lower bond rating. A lower bond rating equates to a higher interest rate. A higher interest rate equates to us having to pay back more money. We need to have more of a measured pace for both the work and the repayment schedule.